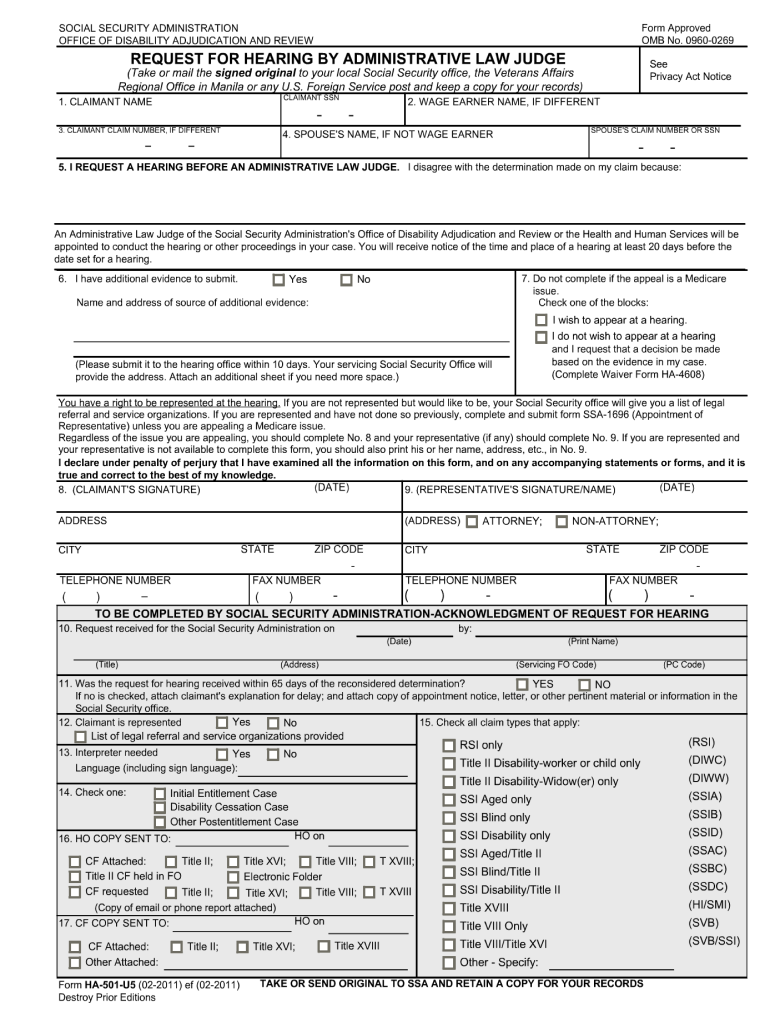

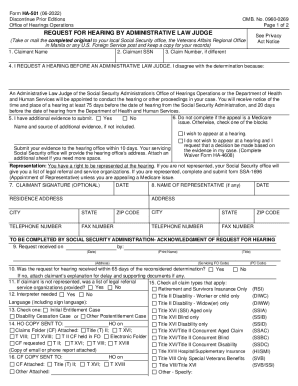

Who Needs Form HA-501?

The official title of the Form HA-501 is Request for Hearing by Administrative Law Judge. This form is used by individuals who have claimed for Social Security Disability benefits but was found ineligible to get them.

What is Form HA-501 for?

With Form HA-501 an individual can ask for appeal hearing concerning their SSD benefits claim. An individual is required to provide a reason for their disagreement with the SSD decision. Form HA-501 gives an individual a choice to attend a hearing or to have a decision made based on the evidence provided.

Is Form HA-501 Accompanied by Other Forms?

Generally, Form HA-501 is a straightforward. It’s brief and doesn’t require additional documents to be attached.

When is Form HA-501 Due?

An important thing to keep in mind about the Form HA-501 is that it must be completed within sixty days after an individual has got their first SSD benefits denial. If you fail to complete your form within the time specified you will have to start the process all over again to claim SSD benefits.

How Do I Fill out Form HA-501?

Form HA-501 is only one page long. It takes some minutes to fill it out. However, you must pay close attention to every piece of information required since it may influence the final decision. Start with personal and contact details. Also provide detailed explanation to the evidence and choose whether you’d like to appeal the decision in person or have it appealed based on your reason. Form HA-501 must be signed and dated by the filer.

Where Do I Send Form HA-501?

Completed Form HA-501 is sent submitted to the local Social Security Office.